Cryptocurrency trading has quickly evolved from a niche market to a global phenomenon, attracting everyone from individual investors to institutional players. With its potential for high returns, crypto trading can be enticing, but it also requires a solid foundation in market dynamics and a disciplined approach. This guide will walk you through the essentials of getting started in crypto trading, covering everything from understanding key concepts to setting up your first trade.

1. Understand the Basics of Cryptocurrency

Before diving into trading, it’s crucial to understand what cryptocurrencies are and how they work. Cryptocurrencies are digital assets powered by blockchain technology—a decentralized ledger that ensures transparency, security, and immutability. Each cryptocurrency, like Bitcoin or Ethereum, operates on its blockchain, serving as both a store of value and a medium of exchange. According to a report by Deloitte, blockchain’s transparency and security features are core reasons behind the growing adoption of crypto.

Cryptocurrencies are highly volatile, and their prices can be influenced by market demand, regulatory news, technological advancements, and even social media trends. Having a firm grasp of these fundamentals is essential to making informed trading decisions.

2. Choose a Reliable Exchange

Selecting the right exchange is one of the first critical decisions in your trading journey. An exchange is where you buy, sell, and trade cryptocurrencies. Each exchange has unique features, fees, supported assets, and security measures. For beginners, reputable exchanges such as UnicoinDCX, Binance, Coinbase, and Kraken offer user-friendly interfaces, educational resources, and robust security measures.

When choosing an exchange, look for:

- Liquidity: High liquidity ensures smoother trades and less price slippage.

- Security: Opt for exchanges with strong security protocols, such as two-factor authentication (2FA), cold storage, and insurance funds.

- Fees: Different exchanges have different fee structures, so choose one that aligns with your trading style and frequency.

A CoinGecko report shows that liquidity and trading volume are crucial indicators of an exchange’s reliability, as they indicate user trust and market stability.

3. Set Up Your Wallet

A cryptocurrency wallet is where you store your assets. While exchanges offer built-in wallets, it’s safer to have a separate wallet for added security. Wallets come in two main types: hot wallets (connected to the internet) and cold wallets (offline storage).

- Hot Wallets: Ideal for active trading, hot wallets like MetaMask and Trust Wallet allow quick access to your funds but come with added security risks.

- Cold Wallets: For long-term storage, hardware wallets like Ledger and Trezor offer offline storage, reducing exposure to online threats. A report from Chainalysis found that cold wallets are essential for securing large holdings, as they are less vulnerable to hacks.

4. Learn Basic Market Terminology

Understanding key market terms is essential to navigating the crypto space effectively. Here are a few important terms:

- Bid and Ask Prices: The bid is the highest price a buyer is willing to pay, while the ask is the lowest price a seller will accept.

- Spread: The difference between the bid and ask prices, which reflects market liquidity.

- Market Orders vs. Limit Orders: A market order executes immediately at the current price, while a limit order executes only when the price reaches your specified target.

- Candlestick Charts: Candlesticks visually represent price movements within a specific time frame and are a vital tool for understanding market trends.

Learning these terms will not only help you make informed trades but also empower you to understand market trends more deeply.

5. Analyze the Market: Fundamental and Technical Analysis

Crypto trading is driven by two primary forms of analysis: fundamental analysis and technical analysis.

- Fundamental Analysis: This approach evaluates the intrinsic value of an asset by analyzing factors such as the project’s team, technology, roadmap, and market demand. For example, Ethereum’s shift to a more energy-efficient consensus mechanism with Ethereum 2.0 added significant value to its ecosystem, according to Ethereum.org.

- Technical Analysis: This involves studying historical price movements to predict future trends. Technical indicators, such as the Relative Strength Index (RSI), Moving Averages, and Fibonacci Retracement, help traders identify entry and exit points. A study by the University of Cambridge highlighted that technical analysis is especially popular in volatile markets, as it helps traders make data-driven decisions amid rapid price fluctuations.

Understanding these analyses can give you a balanced view of market conditions, helping you develop a strategy that aligns with your goals.

6. Start Small and Set Realistic Goals

When you’re new to crypto trading, it’s wise to start with a small investment. This allows you to gain hands-on experience without exposing yourself to significant risk. Remember, crypto markets can be highly volatile, with some assets experiencing double-digit percentage swings in a single day.

Set clear, realistic goals and avoid the common trap of chasing quick profits. According to the Financial Industry Regulatory Authority (FINRA), successful trading is about consistency, risk management, and a disciplined approach. Setting achievable targets and not overextending yourself can lead to more sustainable growth.

7. Manage Risk Through Diversification

Diversifying your portfolio reduces exposure to any single asset, spreading risk across different types of cryptocurrencies. You may consider investing in a mix of stablecoins (e.g., USDT, USDC), blue-chip assets (like Bitcoin and Ethereum), and high-potential altcoins. This diversification can help you withstand volatility, as different assets react differently to market trends.

A study by ARK Invest emphasizes that diversifying within the crypto space can reduce portfolio risk while maintaining high returns. However, always do your research on each asset, as crypto projects vary significantly in purpose, functionality, and community support.

8. Understand the Importance of Timing

Timing is crucial in crypto trading. The market operates 24/7, and price movements can happen at any time. Staying updated on global economic events, regulatory news, and market trends is essential to capitalize on trading opportunities.

Some traders follow market cycles, such as the four-year Bitcoin halving cycle, which historically has led to periods of increased price action. Tools like TradingView can help you monitor price movements and set alerts, allowing you to make timely decisions. However, avoid trying to “time the market” perfectly, as even seasoned traders find it challenging to predict price swings consistently.

9. Choose a Trading Strategy

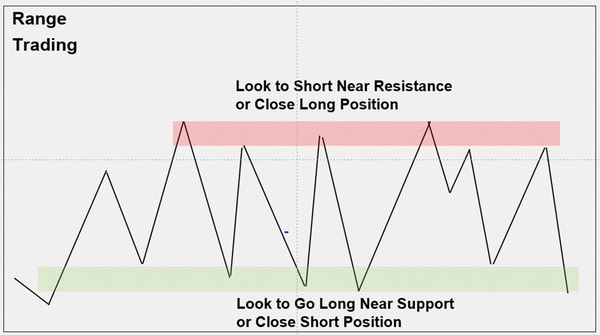

Developing a trading strategy can help you navigate the market more systematically. Here are a few popular strategies:

- Day Trading: Involves making multiple trades within a single day, taking advantage of small price movements. Day trading requires time, quick decision-making, and constant market monitoring.

- Swing Trading: This approach seeks to capture short- to medium-term gains by holding positions for days or weeks. Swing trading is ideal for traders who want to avoid the high-stress environment of day trading.

- HODLing: Popular in the crypto community, “HODLing” means holding assets long-term, regardless of market fluctuations. This strategy is suitable for those who believe in the long-term growth potential of specific assets, like Bitcoin or Ethereum.

Each strategy has its own risk-reward ratio, so choose one that fits your goals, time commitment, and risk tolerance.

10. Practice Discipline and Patience

In the fast-paced world of crypto trading, emotions can lead to hasty decisions and potential losses. Greed and fear can drive you to make impulsive trades, chasing high returns or exiting positions prematurely.

According to a report by the CFA Institute, disciplined traders are more likely to succeed, as they follow their strategy without letting emotions dictate their actions. By practicing patience and adhering to a well-structured plan, you can make more rational, consistent decisions.

Conclusion

Getting started with crypto trading requires understanding the basics, choosing the right tools, and following a disciplined approach. By focusing on these foundational steps, you’ll be better prepared to navigate the complexities of the crypto market and make informed decisions. Remember, the journey in crypto trading is a marathon, not a sprint. Take the time to learn, adapt, and refine your strategy as you grow more experienced.